Investing in art: the complete guide for 2024

%20by%20Andy%20Warhol.%20Courtesy%20Christie%E2%80%99s%20Images%20Ltd%20.avif)

Beyond its rewarding and stimulating nature, investing in art has many advantages in terms of potential financial profitability. But before you start, it is essential to know the fundamental bases of this particular type of investment. Discover the complete guide to investing in art in 2024 now.

Financial investments can be divided into four main categories:

- Monetary investments, such as passbooks placed in banks;

- Shares and bonds, such as the holding of shares in a listed company, or debt claims from the State or companies;

- Real estate, such as owning an apartment or a house from which rent is paid;

The alternative investments, such as private equity placements, commodities, or assets like art and collectibles.

Why invest in art?

In addition to its simple aesthetic nature, investing in art offers unique opportunities and earnings potentials that are often greater than those of traditional financial markets like the stock market or real estate. In addition to providing profitability, investing in contemporary art also offers a symbolic aspect, conveyed by cultural and artistic values.

Since the 1990s, investment in art has attracted more and more investors. Formerly reserved for an elite of connoisseurs or collectors, audiences have largely diversified, even democratized, over the years, in particular thanks to the development of digital technology.

Diversifying your investments

All investors know this golden rule: To dilute risk, assets must be diversified. Diversifying one's assets corresponds to the action of investing one's money by multiplying media (such as real estate, banking, the stock market, or even art). By diversifying their investments, the investor benefits from the advantages inherent in each investment and thus limits his risks. The idea? Assuming that the risk is diluted (and that no investment loses value at the same time), in the event of a depreciation in value on an investment (unpaid rent, fall in a share, etc.), other investments are supposed to compensate for this loss.

While the favorite investment of the French today remains real estate for its guarantee of stability and profitability, investing in art represents an interesting option for people looking to diversify their assets. However, this investment is considered riskier, but with the potential for higher financial returns. Also, investing in art allows you to combine business with pleasure, by combining the potential for financial profitability and the prestige of owning a work of art.

The advantages of the art market compared to traditional markets

Investing in art has a number of advantages over more traditional investments. Here are a few of them:

- A decorrelation of financial markets. Unlike shares placed on the stock market or real estate, the art market is uncorrelated from economic fluctuations. This type of investment therefore offers stability and protection against financial crises. By integrating works of art into their portfolio, investors spread risks and improve the stability of their investments over the long term.

- Inflation protection : As a tangible asset and a safe haven, the art market also offers protection against currency depreciation, while benefiting from scarcity and ever-increasing demand.

- A potential for appreciation Invested capital : Some works of art can also see their value increase significantly, especially when it comes to mythical, established and recognized artists. As a result, returns can exceed those of stocks and real estate.

- Long-term stability : Art, especially ancient and contemporary art, has demonstrated an ability to maintain stable growth of its value over the long term.

- Tax benefits : In France, capital gains on the resale of works of art can benefit from reduced tax rates after a certain period of ownership.

- Diversifying its portfolio Of assets : Integrating works of art into an investment portfolio allows you to diversify your assets and reduce your risk taking. Diversification is a relevant strategy for wealth management because it helps balance profitability and protect capital.

- Sentimental, emotional and social value : Unlike stocks and real estate, art, by nature, has a strong emotional value. Works of art can be appreciated for their beauty, cultural significance, or for personal and social enjoyment, adding a non-financial dimension to the investment.

Why contemporary art?

At Matis, our conviction can be summed up in one sentence: we believe that art is an eternal heritage of mankind. This rapidly changing market represents more than 5% of the assets of the world's largest fortunes and individuals. The volume of transactions (65 billion euros in 2022), the performance in terms of profitability and the rise in the number of auction houses demonstrate the dynamism of this sector.

At Matis, our investment strategy is based on the selection of works created by carefully targeted 20th century artists who have marked the history of art. This strategy is divided into three fundamental pillars:

- A specialization in contemporary art : At Matis, we focus on post-war art and contemporary art. Why? Because this market represented almost 54% of the total value of public auctions in 2022. This artistic segment testifies to its dynamism and liquidity compared to other movements.

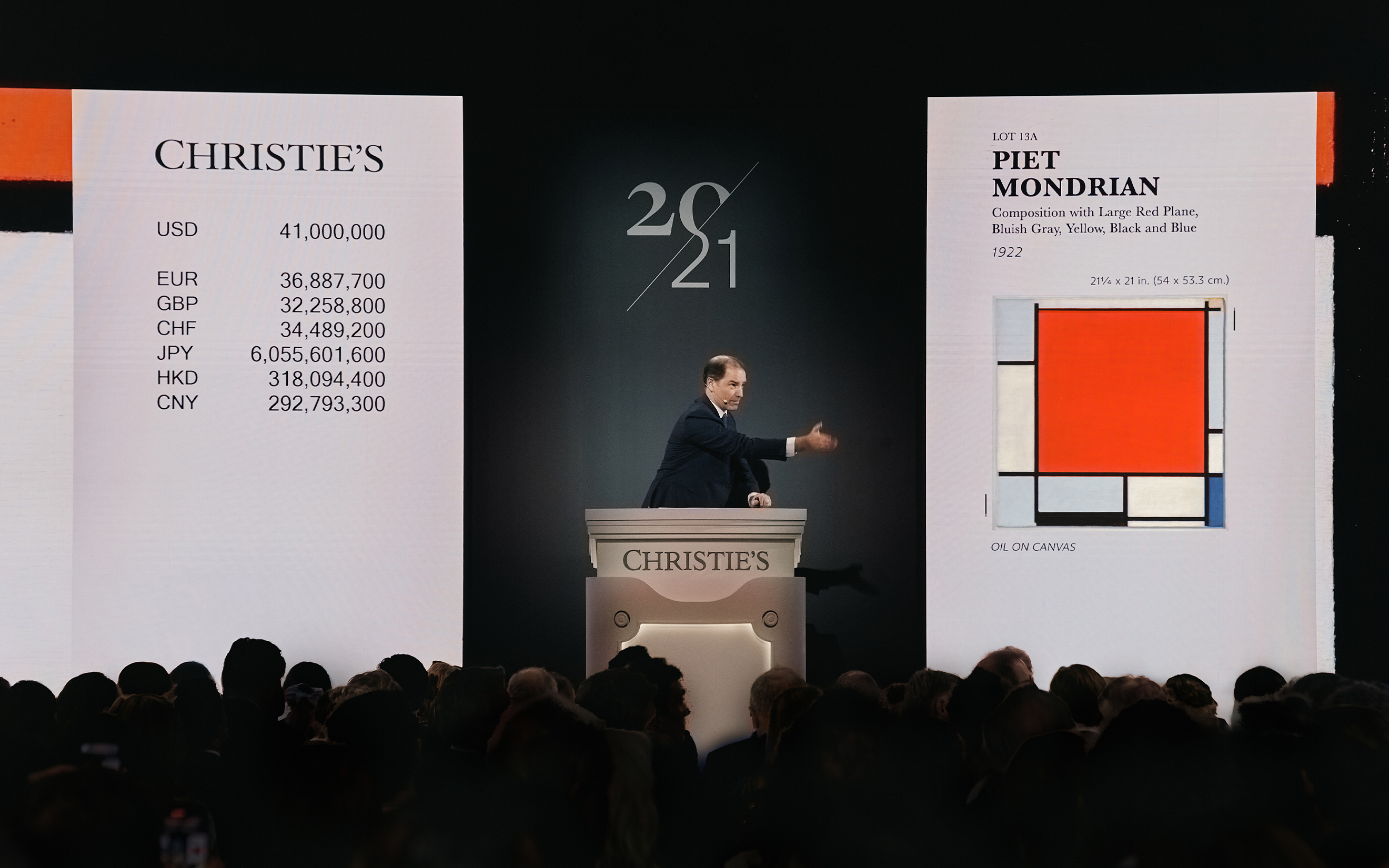

- Works valued at over $500,000 : Within the contemporary art market, market value focuses on”blue chips*”, with a valuation greater than $500,000. These works represent more than 60% of the total value of auctions, for only 1% of the works exchanged.

- A selection of works created by established iconic artists : the "blue chip" works were created by artists who have profoundly marked the history of art, who are recognized by museum institutions, the world's main galleries, as well as international collectors.

What types of art should you invest in?

Styles, eras, movements, artist categories, ratings... Many parameters must be taken into account before investing in art. When talking about investment, it is possible to categorize works of art in three main types : ancient art, impressionist and modern art, and contemporary art.

Old masters

When it comes to the art market, ancient art refers to works produced before the 19th century. Representing 9% of the global art market in 2023, it is a market for passionate collectors characterized by a large volume of available works exchanged at low values. Most of the major works of ancient art have already entered museum collections and are out of the commercial system. Moreover, it is characterized by a lack of transparency and the difficulty of guaranteeing the attribution and authenticity of pieces.

As a result, supply is dwindling and demand is lacking fervor. Thus, the ancient art market is not well suited for investment.

Nevertheless, there are still some beautiful market rediscoveries that attract the interest of a very small and specific number of collectors.

This painting, missing since 1668, reappeared on the market in 1920 but was no longer recognizable due to various additions and discolored varnish. Presented for sale as a studio version in 2015 at Christie’s, it sold for £254,000. Nearly 10 years later, specialists recognized it as the first version of Metsys's masterpiece. Thus, it was presented again in May 2024 at Christie’s in London and was purchased for £10 million by the Getty Museum.

Impressionist and modern art

Impressionist and modern art represents 40% of the art market in 2023. However, there has been a decline in the number of transactions since the 2000s. This is mainly due to the very high prices of works from this period. The works still available on the market are difficult to buy and sell, and are thus accessible only to a privileged clientele of collectors, making this market undemocratic and not very accessible.

Contemporary art

The contemporary art market represents half of the global transactions. It is primarily American and is the most democratic segment of the art market: the prices of artworks range from tens/hundreds of euros to over 200 million euros. Thus, it is the market with the highest volume and value of sales, and where growth is the strongest.

Artworks created by renowned contemporary artists show a constantly increasing value. According to the Artprice100 index, the benchmark index that measures the financial performance of the 100 most important and influential artists in the market, the majority of "blue chip" artists are from the modern and contemporary art sectors.

At Matis, we select works from these two artistic movements:

- Modern art, created by artists from the first half of the 20th century;

- Contemporary art, created by artists after 1945.

These two artistic movements alone account for nearly 80% of global art market transactions. Thus, in our acquisition strategy, we prioritize works created by these iconic artists, as they represent the most reassuring segment of the market: their market is international, sought-after, and allows for the highest capital gains.

Investing in art: which artist?

Choosing the right artist to invest in is a tricky business. It can be useful to have some art knowledge and investment skills before you start. Also, not that this type of purchase is reserved for an elite or a circle of insiders, but some questions deserve to be asked. Here are a few of them:

Choosing the right artist

- What is the reputation and rating of the artist?

Find out about the artist's fame and recognition in the art world. Find out about his career, his exhibitions, where his works have been exhibited, and the names and reputations of the collectors who own his works. This should help you assess its rating and evolution. You can also rely on specialized sites such as Artprice, Artsy, Artnet or Artfinder.

- What is the trend of his career?

Analyze the career path of the artist you are targeting. Rising artists, whose fame is growing rapidly, may see the value of their work increase as their recognition grows. Also, find out about artist rankings based on their ratings.

- What is their sales history?

Research the specific market for the works of the artist in question. Recent auctions, private transactions, and market trends can provide valuable insights into demand and prices.

- What is its future growth potential?

Evaluate the potential for future growth in the value of the artist's works. Factors such as upcoming exhibitions, positive critical publications, and artistic collaborations can stimulate interest in her creations.

- Does the targeted artist have an international reputation?

Consider an artist whose work sells internationally. In particular on the most famous art marketplaces in the art world (New York, London, Paris).

- Do you like the work of this artist?

Make sure the work speaks to you aesthetically and emotionally. Personal appreciation of art is essential for your own satisfaction as a collector and investor.

- Get help

The art world is a particular world. Internationally renowned experts or gallery owners speak in magazines, and sometimes set the tone for future ratings and trajectories of artists.

How Matis selects his artists

The selection of artists constitutes the core business and expertise of Matis. With the help of our team and our collaborators with a solid background in art, we choose artists after a meticulous analysis of the art market, and a careful and detailed examination of private transactions and auctions of the largest auction houses. We also analyze the major current and future trends in the art market, and focus our analyses on the 100 fundamental artists of the 20th century.

Matis then searches for his works from professionals in the art market (galleries, dealers or auction companies). Thanks to its privileged network, our team identifies works that it considers undervalued and acquires them. The works are then selected for their ability to be sold quickly via international galleries, specialists in the artist concerned, within a target horizon of two years, and are only purchased after validation by an acquisition committee.

The artists selected have profoundly marked the history of art. Their works available for sale on the market are dwindling, while their value is increasing, creating a scarcity effect. Among our targeted artists, we can mention:

- Andy Warhol

- Pierre Soulages

- Jean-Michel Basquiat

- Yves Klein

- François-Xavier and Claude Lalanne

- Yayoi Kusama

Today, our artists are recognized by the largest international museums and promoted by the most renowned galleries. In addition, we only focus on "blue chip" artists.

The pitfalls to avoid when investing in art

Investing in art can be both exciting and lucrative. However, this type of investment has many pitfalls. Here are a few to avoid:

- The lack of knowledge : It is essential to fully understand artists, artistic movements, market trends, and the value of works before investing.

- The trend effect : Trends in the art world can be fleeting. Buying a work simply because it is currently trending can lead to significant financial losses.

- The lack of authenticity : Counterfeiting is a real problem in the art world. It is essential to verify the authenticity of a work before investing.

- The associated costs : Art purchase costs include gallery commissions, auction fees, insurance and maintenance costs. These costs can significantly reduce the profitability of the investment.

- Investing without diversification : Investing your funds in a single work or a single artist can be risky. It is essential to diversify your investments in order to reduce your risk.

- Ignorance of trends : Without necessarily following the effects of fashion, it is important to know the main trends in the art market: those that are promising and those that are not so promising.

- The importance of experts : Professional advice can be valuable. They provide quality information that is often not easily accessible to the general public.

Tools and methods for investing in art

There are several methods for investing in art, each with advantages and disadvantages, as summarized in this table:

Fractional investment

Fractional investing is an investment method that allows investors to buy part of an asset, rather than all of it. In other words, instead of spending a large amount of money to acquire an asset in its entirety, investors can buy “fractions,” or shares of that asset. Particularly common in the field of real estate, this type of investment has also been developing since the 2010s in works of art or collectibles.

What is a club deal?

A club deal is a form of investment collaboration where a group of investors, often institutional or wealthy investors (High Net Worth Individuals), are joining forces to finance a major investment project. This type of partnership is particularly common in the fields of real estate, infrastructure and private equity. It is developing more recently in the field of art.

How to invest with Matis?

Through exclusive, Matis proposes to invest in works by major artists of the 20th century by its team of experts. By focusing on people and combining cutting-edge expertise in art and distribution, Matis offers a unique investment experience. Here are the steps of an investment with Matis:

- Matis identifies the major trends in the art market for you;

- Matis selects major works from post-war art;

- Matis club deal structure to make it easier for you to invest;

- Matis entrusts the acquired works to major galleries for resale;

- When the work is sold, you get back the invested amounts as well as the added value, not guaranteed.

To find out more about your future investment experience, go to this page.

Taxation of the purchase and resale of art

The taxation of works of art varies according to several factors, including the nature of the transaction (purchase or sale), the situation of the buyer or seller (individual or professional), and the country where the transaction takes place. Here is a general overview of the taxation applicable in France for the purchase and sale of works of art:

.png)

.jpg)